According to a study by Associated Chambers of Commerce & Industry of India (Assocham) the Indian e-commerce industry is valued at $17 billion in 2014 and is likely to clock a compounded annual growth rate (CAGR) of around 35%. This will make it a $100 billion industry in next five years.

Factors such as increasing mobile penetration, internet connectivity, use of plastic money and improved logistics are all playing a part in significantly increasing the number of people making purchases online. It’s not only the consumers, rather both respected individuals in industry, government and investor community have time again pointed out that the Indian ecommerce opportunity is here to stay.

Read on to know the seven trends to watch this year to keep yourself competitive and always ready for an opportunity.

E-commerce and rise of enablers

With the ecommerce market growing insanely, companies which provide back end support, be it logistics or payment are also growing with a break neck pace. Not only is the business opportunity good, these companies are investing heavily into technology to make their operations more lean and nimble. If we see

newspapers of last one year, you will notice that there have been some large scale money being invested into this sector. Be it Rs 210 crore capital raising by Delhivery, a

Gurgaon headquartered logistics company, or Mumbai based Ecom Express raising Rs 100 crores. According to some estimates by reputed analyst houses the ecommerce logistics enablers have seen deal values grow by almost 780 percent in last two years. Similarly, Forbes India in one of its articles pointed out that due to the pace of the ecommerce market growth, there is still scope for two to three big logistics firms to start up their business.

Rise of aggregators and vertical players

With three horizontal ecommerce biggies namely Flipkart, Amazon and Snapdeal, there seems to be very less space for any other player capturing the market. The triad as mention above, deal with multiple product lines and are rightly called horizontals. However, this leaves enough elbow room for specialized players focusing on particular verticals to set up a profitable business. Case in point is of successful vertical players such as CaratLane and BlueStone (Jewellery), Pepperfry (furniture), Lenskart (eyeware), BigBasket (grocery) and so on. Not only products even vertical focused services are doing good business, such as, Ola (cab aggregators), Housing.com (real estate), BookMyShow, Policybazaar (insurance) have emerged as front runners in their categories. It seems players who missed the bus earlier can still get onto the bandwagon by focusing on verticals and it’s still not late to implement an innovative idea.

Mobile, mobile and mobile

Mobile phone, that too smart phone penetration has improved connectivity to a very large extent. It’s not uncommon these days to see all big ecommerce players racing against each other to lure netizens to install their phone app and start using it as their primary device. Even customers don’t think twice before ordering a product online from their smart devices. This space is bound to go crowded with players launching services from search to ordering to

payment and delivery tracking, all built onto mobile devices. Obviously this helps the companies to gain mindshare or buyers with targeted advertising as

mobile as a device is always in close reach of an individual. Even search giant Google has now brought in changes to its search engine which will rank

mobile friendly websites higher than non-compatible ones if search is done on a mobile device. Watch this space to see really innovative solutions from large companies targeting the smart phone users.

Profitability still reclusive

Well, this depends on verticals being looked into. Travel, for instance has turned out hugely profitable and is dominated by likes of yatra.com or makemytrip.com. However, if we think of online retail, the picture becomes grainy. None of the Indian online retailers have reported profitability yet. Having said that, same is the case with Amazon, world’s largest online seller. Its business is still not profitable or little profitable depending upon the year you look at. Alibaba, the Chinese retail industry poster boy, became profitable only after 11 years of operation and is currently one of the most profitable online retail business. Its initial public offering on the New York Stock Exchange last year gave a hope to online retailers in India that the business model works and profitability is just a matter of time. Seeing the current flurry of investments made by many private equity and venture capital firms in India it seems same optimism runs in them as well. However, only time will tell if the current sky high valuations of the poster boys of Indian online retail industry are realistic and justified. In the meantime customers will remain the true king!

Sky high valuations and huge investments by private equity and venture capitals

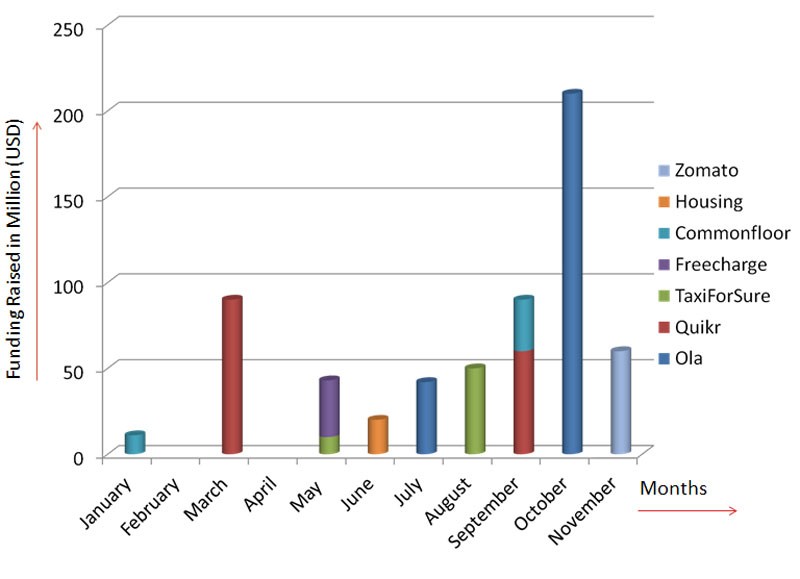

Without going into each and every specific investment announcement done last year, it’s probably best to say that the valuations were just eye popping, refer to the chart below for more details. According to Forbes India latest issue, the segment raised around $4.1 billion across 106 deals in 2014. Well known ecommerce players namely Flipkart, Amazon, Snapdeal, Myntra, Olacabs, Quikr to name a few raised capital. Besides well-known investors such as Tiger Global, Sequoia and Naspers among others, the industry drew the attention of new investors like DST Global, Soft Bank, Black Rock and Sofina etc. Just to give a regional flavor, these investment houses are headquartered in Japan, Singapore, United States, United Kingdom and India to name a few.

Source: Yourstory and Venture Intelligence

Consolidation of players

Within the highly competitive ecommerce industry where customer loyalty is fickle and investments drying up, it is difficult for many smaller companies to continue running the shop. On the other hand, many large players are slush with funds from their recent round of funding. Additionally, not every big player will have the relevant technology to serve customers better. All these factors prepare a suitable environment where bigger players will like to pick niche small players. Again, horizontal ecommerce companies know that profit margins are high in specific verticals e.g. fashion and private labels, and would like to get one such company instead of starting from scratch. Some notable examples are Flipkart’s acquisition of Myntra (fashion), Snapdeal acquiring Wishpicker (gifting technology platform). Industry pundits feel that the trend is going to continue as investors want to have a winner and all want to be a part of that winner.

Also read : 7 Best E-commerce Solutions for Small Businesses

Brick and mortar stores playing their part now

After a long time even brick and mortar players are seeing their business improve. Some have started adopting the ecommerce bandwagon or have started acting as a pick and drop points for the deliveries in far flung areas. Companies such as DotZot, the ecommerce logistics arm of DTDC Couriers and Cargo, GoJaVAS, previously logistic arm of Jabong, Amazon, India Post to name a few have all tried or run pilots to cover the last mile for these etailers. Note that the cost of setting up a delivery network is most costly at the last mile and also most loss prone. Current year would see this experiment expand to more vendors finalizing their plan, ultimately benefiting these mom and pop stores.

Do let me know what do you think about ecommerce trends on comment below